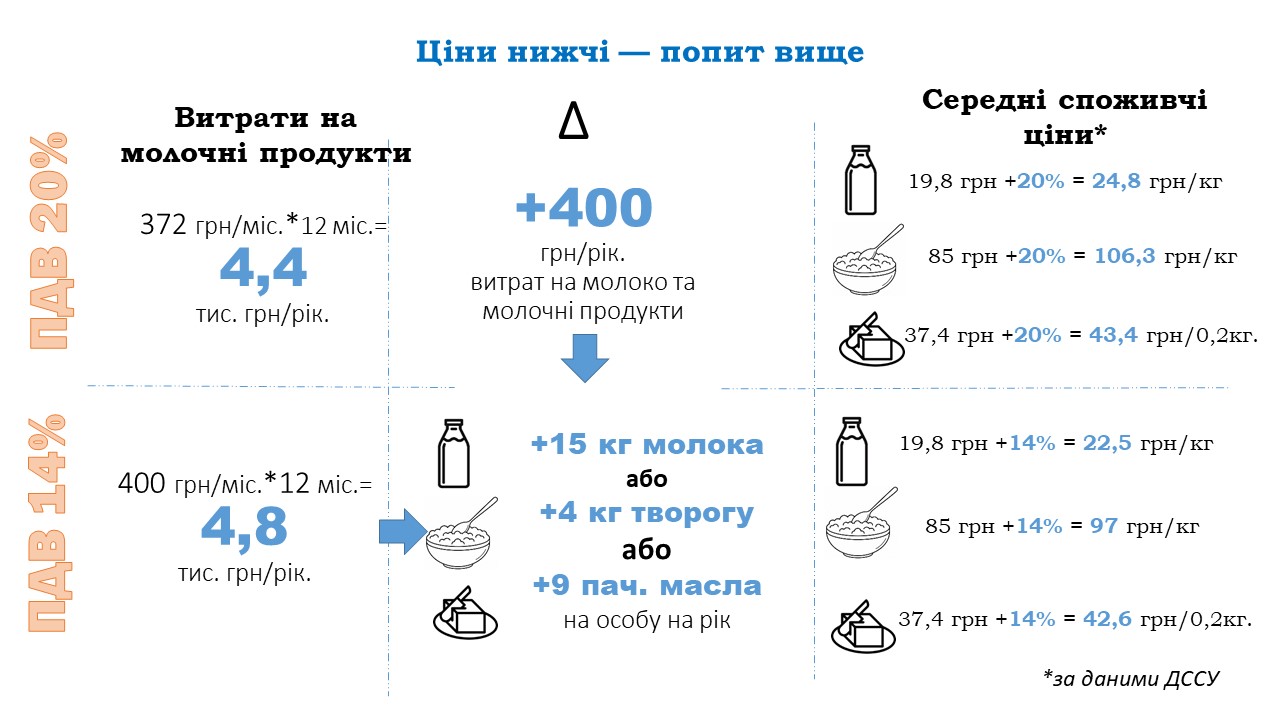

Due to lack of raw materials in Ukraine, dairy products and sugar become more expensive. Moreover, the trend of their growth will continue. We expect that before the end of the year prices for dairy products will grow by 2.5% -5.5%: from UAH 0.5-0.6 for milk to UAH 4-5 for butter. In addition, after the end of the sugar season, sugar prices will to rise by 2% - UAH 19-20 per kilogram.

The way out of this situation may be the value added tax (VAT) rate reduction from 20% to 14% on finished dairy products (milk, sour cream, cheese, butter) and sugar. This will help to reduce the price of these products and increase the purchasing power of Ukrainians. This issue was discussed today during the press conference "Ukraine without milk and sugar - why production is reduced" organized by Ukrainian Agri Council.

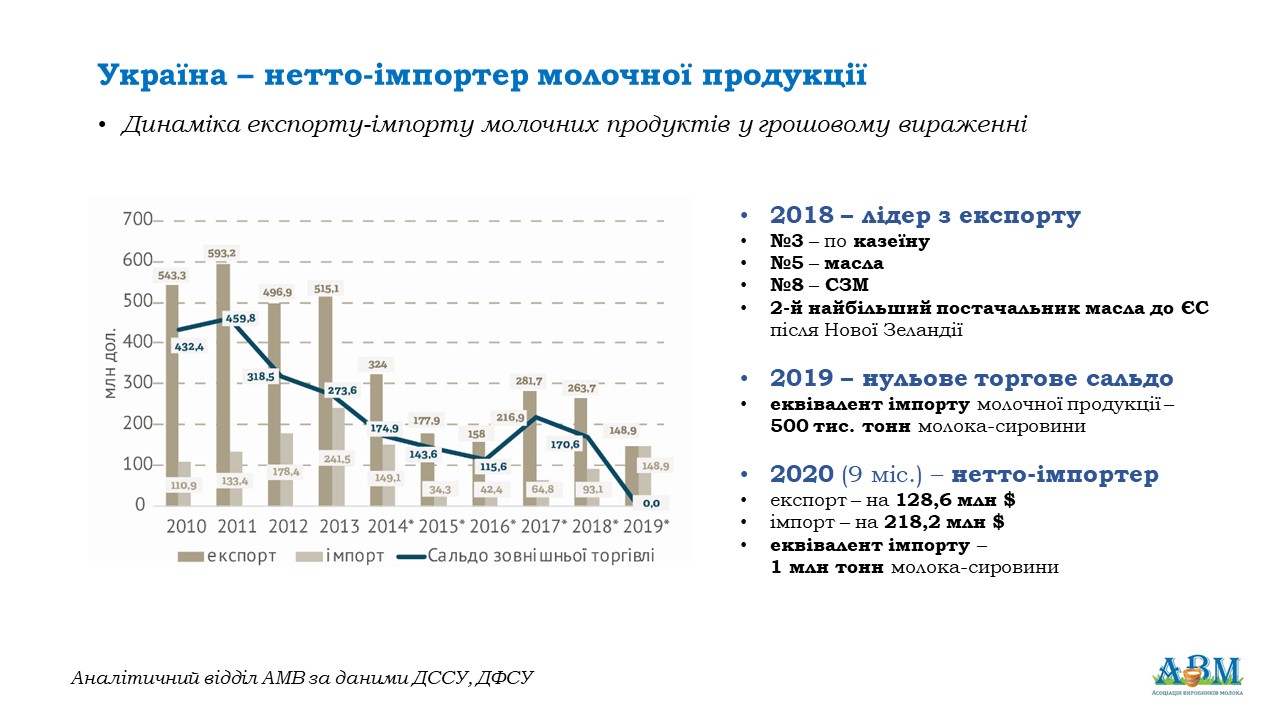

According to words of Vice President of the Association of Milk Producers (AMP) Anna Lavrenyuk, this year Ukraine became a net importer of dairy products for the first time and stands a good chance to become an import-dependent country in this direction. In the industrial sector, which provides more than 80% of milk for processing, livestock is declining rapidly. Last year, Ukraine lost about 33,000 cows. This year the trend continues – we lost about 1.5-2 thousand cows every month.

"Deepening in the milk crisis for us means the loss of the dairy industry. If we continue to reduce livestock and milk production, we will become a fully import-dependent country. This thing will destroy our economy. The dairy industry is the largest generator of jobs in the agro-industrial complex and the largest taxpayer. We need to pay attention to the strategies of advanced countries: reducing the VAT rate on dairy products and a long-term strategy of state support. "VAT reducing on milk is a very effective tool to support demand for dairy products and raw materials, and economically support the entire industry," Anna Lavrenyuk said.

"Deepening in the milk crisis for us means the loss of the dairy industry. If we continue to reduce livestock and milk production, we will become a fully import-dependent country. This thing will destroy our economy. The dairy industry is the largest generator of jobs in the agro-industrial complex and the largest taxpayer. We need to pay attention to the strategies of advanced countries: reducing the VAT rate on dairy products and a long-term strategy of state support. "VAT reducing on milk is a very effective tool to support demand for dairy products and raw materials, and economically support the entire industry," Anna Lavrenyuk said.

According to the AMP Vice President, if the VAT rate on dairy products is reduced to 14%, Ukrainians will be able to buy about 15 kg of milk, 4 kg of cheese and 9 packs of butter during a year. For the industry, this means an additional need of 1 million tons of milk. This is an incentive to increase the number of cows, create new dairy farms and additional jobs.

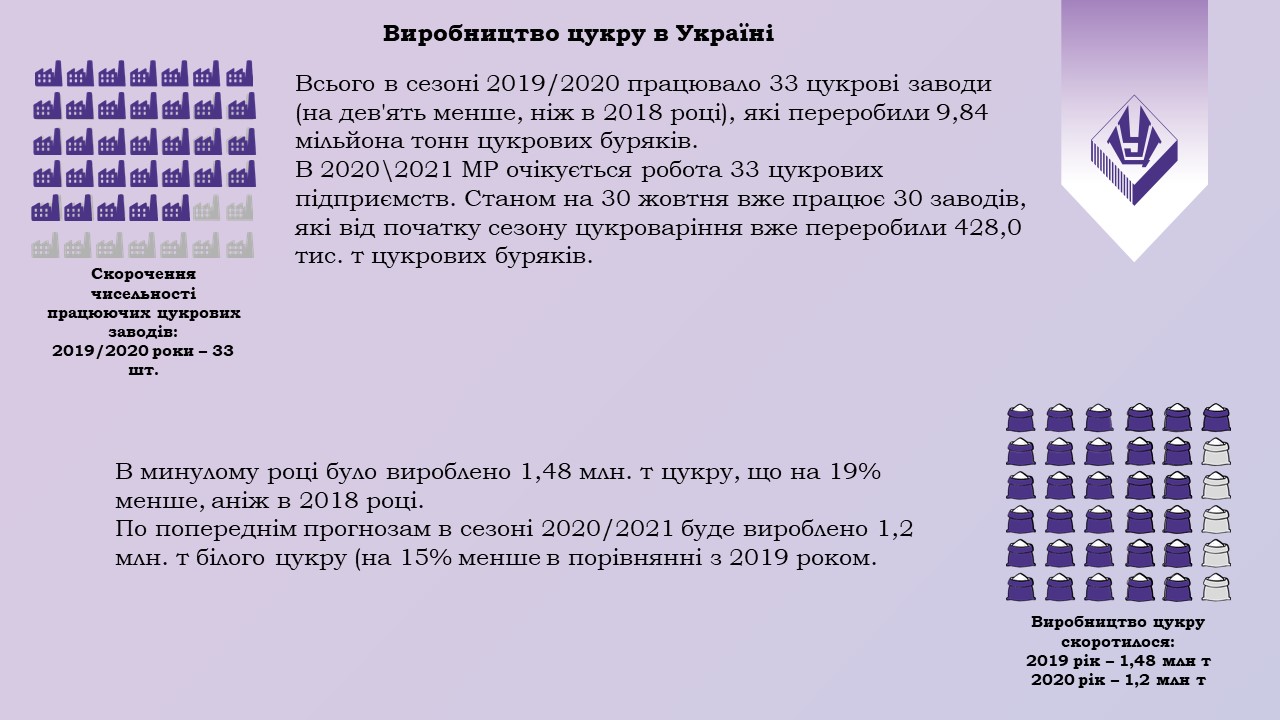

National Association of Sugar Producers of Ukraine "Ukrtsukor" analyst Nazar Mykhailovyn mentioned that the area under sugar beets in the country is declining steadily. Therefore, last year 220 thousand hectares of sugar beets were sown, and this year we sowed 209 thousand hectares. In addition, sugar production has been declining over the last three years: from 2.14 million tons in 2017 which were planed to sow 1.2 million tons in the current marketing year.

National Association of Sugar Producers of Ukraine "Ukrtsukor" analyst Nazar Mykhailovyn mentioned that the area under sugar beets in the country is declining steadily. Therefore, last year 220 thousand hectares of sugar beets were sown, and this year we sowed 209 thousand hectares. In addition, sugar production has been declining over the last three years: from 2.14 million tons in 2017 which were planed to sow 1.2 million tons in the current marketing year.

"Given this trend, sugar exports are declining. Therefore, we support the VAT rate on sugar reducing to 14%. After all, this will help to increase sugar consumption in the domestic market, increase sown areas, restore the work of most plants and jobs," Nazar Mykhailovyn said.

UAC Deputy Chairman Mykhailo Sokolov, said that the goal of the VAT reducing policy on finished products in the European Union is, first of all, the availability of food.

UAC Deputy Chairman Mykhailo Sokolov, said that the goal of the VAT reducing policy on finished products in the European Union is, first of all, the availability of food.

"VAT is a tax that is paid by the consumer. Therefore, by reducing the VAT rate, and with it the price of the dairy products line, we increase the purchasing power of our citizens. For producers, the price without VAT is important, because they will pay all the received VAT to the state anyway. Therefore, when we say that Ukraine needs to follow the experience of the European Union and reduce the VAT rate on dairy products, we are fighting for the health of the nation and future generations. For people to be able to afford a healthy diet," Mykhailo Sokolov said.

At the same time, UAC Deputy Chairman claimed, that in this case there is a question of its survival. After all, in Ukraine sugar is produced only from sugar beet. Moreover, the decrease in sow areas shows negative trends in the industry. Therefore, measures must be taken to save it. In this case, we offer to reduce the VAT rate to 14%.

UAC proposed appropriate amendments to the draft law №3656, which provide for a VAT rate reduction from 20% to 14% on: milk and dairy products, including butter, cheese of all kinds and sour milk cheese; cattle and pig meat; sausages and offal from relevant meat; beet sugar. People’s Deputies Oleksandr Kovalchuk and Oleksii Ustenko submitted the amendments. Currently, the bill is ready for consideration in the Verkhovna Rada in the first reading.

Therefore, UAC, Ukrtsukor and AMP call on People’s Deputies to support the bill and the relevant amendments, making products more accessible to Ukrainians.

Tuesday, 3 November 2020