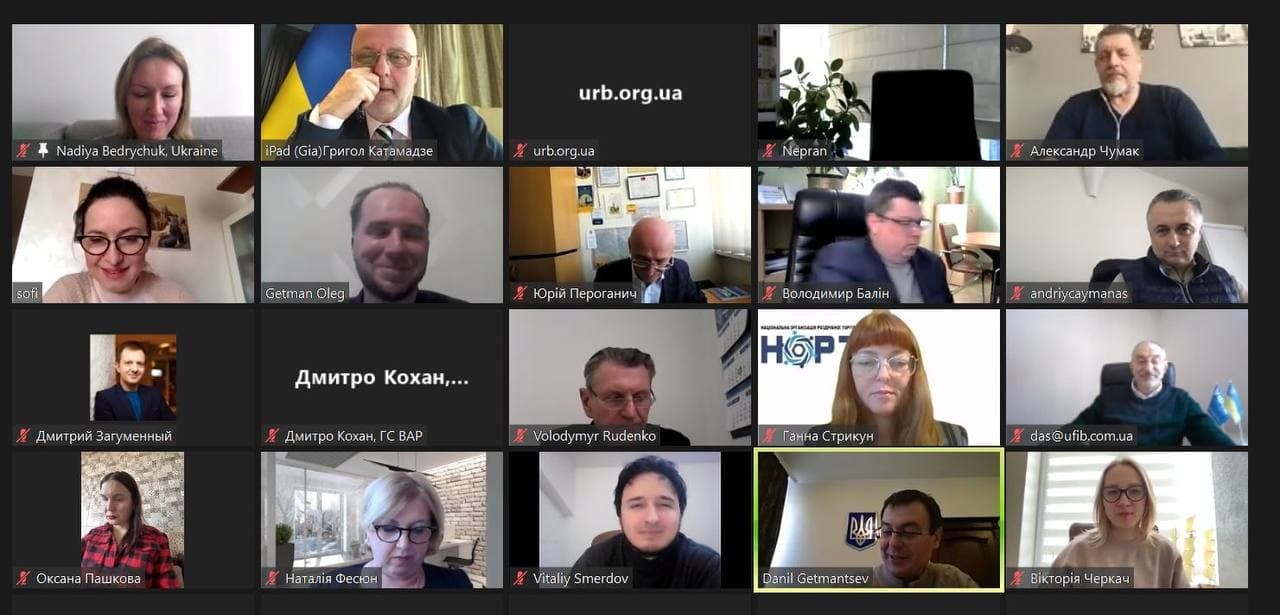

A meeting of Ukrainian business associations with the Chairman of the Verkhovna Rada Committee on Finance, Tax and Customs Policy Danylo Hetmantsev was held, organized by the Ukrainian Business Council, a participant of which was the UAC.

Representatives of business associations provided suggestions for resolving certain problems that arises. In particular, Dmytro Kokhan, an advisor to the UAC Chairman, made three proposals.

The first proposal is to create a mechanism of tax subsidies for citizens who could deduct a certain percentage in favor of public organizations or political parties. It will make institutions more independent and efficient. The UAC advocates that citizens have the right not only to determine who will receive their funds in the form of taxes, but also to be able to indicate what specific actions they expect from this party or organization.

The second proposal is to reduce VAT on food as an anti-crisis measure. The UAC has long and consistently advocated the adoption of this initiative. Currently, the VAT rate in Ukraine is 20%, which is a high markup. After all, in Europe, the VAT rate on food is 5%-7%. Moreover, amendments to the European directive are already being prepared, according to which the VAT rate on food will be reduced to 0%.

The third proposal is to introduce an excise tax on sweet carbonated drinks, as a compensator for the reduction of wage taxes, which has already been made by most EU’s countries. Excise funds for such drinks should be directed to two programs - the fight against diseases associated with malnutrition and funds for the "School Milk" program.

Monday, 7 February 2022