On February 25 at 11:00 A.M. in Kherson city a professional discussion of the adopted Law on Amendments to the Tax Code of Ukraine on the value added tax rate on transactions for the certain types of agricultural products supply, which reduces the VAT rate for farmers from 20% to 14%.

You will be able to learn how agricultural enterprises will work after the law comes into force. You will hear its detailed analysis on specific examples of agricultural enterprises you will see the VAT rate reducing benefits. We will also shatter illusions about “horror stories" with which opponents of lowering the VAT rate try to intimidate farmers.

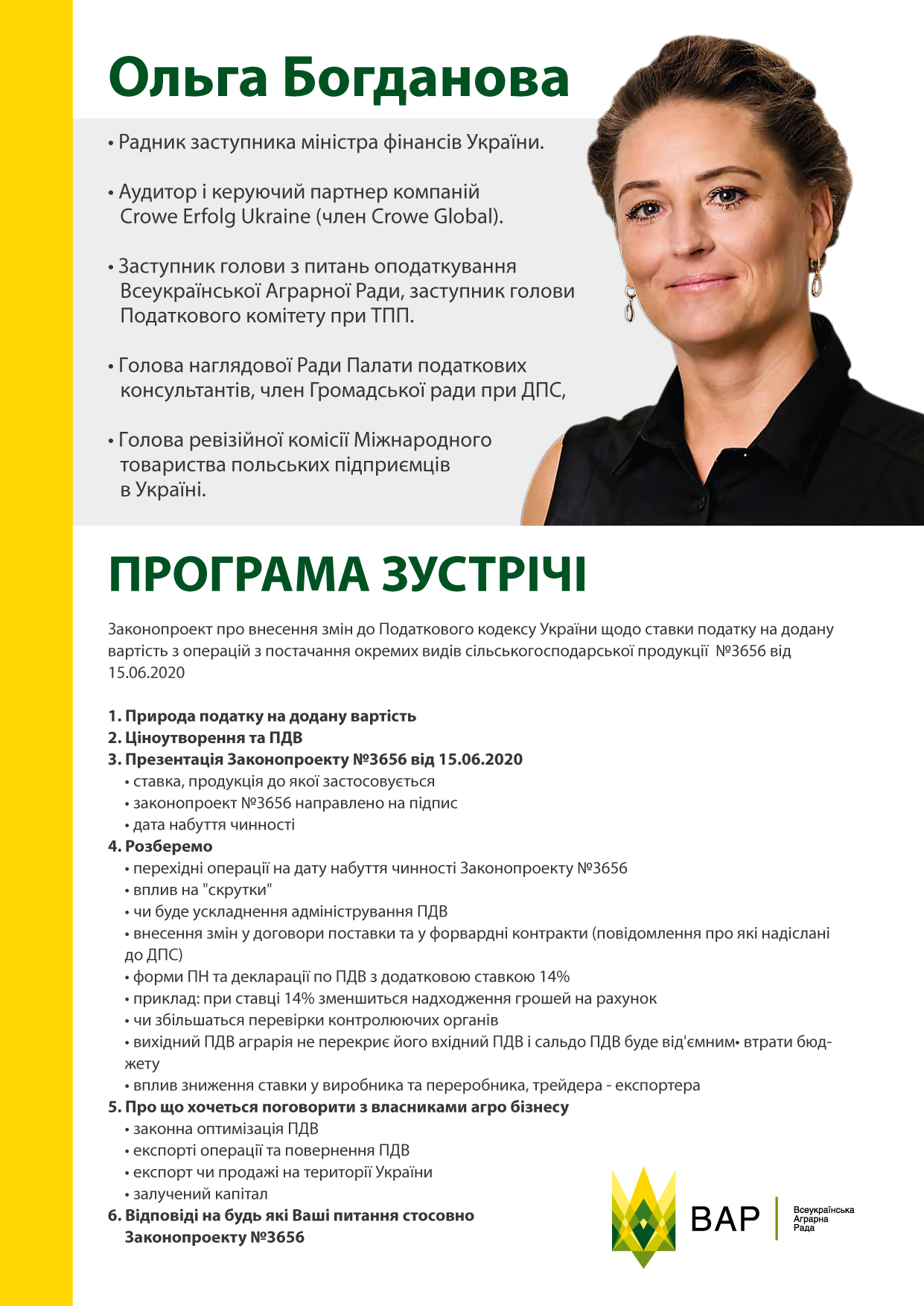

Speaker - Tax Professional Olha Bohdanova - the Deputy Minister of Finance of Ukraine Adviser, Managing Partner of Crowe Erfolg Ukraine (member of Crowe Global), Deputy Chairman of the Tax Administration, Deputy Chairman of the Tax Committee at the CCI, Chairman of the Supervisory Board of the Chamber of Tax Advisers, Member of the Public Council at the State Tax Service, Chairman of the Audit Commission of the International Society of Polish Entrepreneurs in Ukraine.

Participation is free for the participants who have restarted beforehand

To take part in the meeting in Odesa region, please, fill in the form: https://docs.google.com/forms/d/e/1FAIpQLSe_497ec8mXgEi9zrOIuYnUkOLo1EvtIXK5UnEZrEwLXc1bcw/viewform

To take part in the meeting in Kherson region - https://forms.gle/6wsgHvUb3prcWXG86

Details of the meeting are in the program