The beginning of 2022 was overshadowed by the scandal in the dairy market of Ukraine and mutual accusations of milk producers and processors of artificially inflating and lowering of raw milk prices.

The scandal has reached such a level that the Ministry of Agrarian Policy and Food of Ukraine was forced to hold meetings and consultations with market participants during the New Year holidays.

However, the conflict wasn’t solved. The parties accuse each other of misconduct and blackmail.

The only thing they agree on is that if this continues, the dairy industry would face a final decline: the closure of farms and processing factories, the loss of thousands of jobs and the seizure of the Ukrainian market by imported dairy products.

It is almost impossible for the unprepared person to understand what is happening. Therefore, let's try to explain what is going on, based on the facts, through the milk producers’ eyes. We hope that the processors will be able to express their position, also guided by the facts.

Market prices’ reduction or monopoly conspiracy

The starting point of the scandal was the mass receipt by farms of protocols on prices reduction, which were sent by more than 24 processing factories to their suppliers on December 29-30.

In the letter, they noted that from January 1, 2022, they would unilaterally reduce the purchase prices for raw milk. The appeal was direct: either you agreed to such conditions, or you couldn’t bring milk for processing.

At the time of receiving the notification of lower prices, the scale of the problem for milk producers was unknown. However, it immediately caused outrage, because at this time it is impossible to find other buyers.

Anyway, you will have to supply milk at a reduced price at least until the 20th of January, because you can find another buyer only after the New Year holidays.

The fall in prices in January is not something new. After the holidays, the demand for dairy products is temporarily falling and, as a result, prices are falling slightly. However, this has never happened unilaterally and simultaneously since January 1.

Until now, each processor has been negotiating with its suppliers, as a result of which they have agreed and found a compromise, of course, each has his own compromise, as milk production in winter also declines.

In addition, there is still an acute shortage of really high-quality milk in Ukraine - only 30% of milk supplied for processing, according to its quality indicators, would be used for food production in the EU.

Accordingly, producers of quality milk have always been on special account with processors.

Also, farmers were not ready for the fact that the price would be required to be reduced immediately by 10%. This is an unprecedented collapse, which, according to the Association of Milk Producers, makes all farms with less than 500 heads unprofitable.

And this is more than half of the milk produced in Ukraine and, accordingly, jobs in the whole industry.

In response, the Association of Milk Producers stated that it was considered a monopoly conspiracy to unilaterally raise raw milk prices by processing plants and demanded to stop violations of the law: to return previous prices and start negotiations between processors and their suppliers without price collusion.

Otherwise, the association will apply to the Antimonopoly Committee of Ukraine. Unfortunately, despite the intervention of the Ministry of Agriculture, the situation has not changed.

Economics of the milk crisis

At a meeting at the Ministry of Agriculture, processors said that purchase prices for raw milk in Ukraine are higher than European ones, so they cannot compete with European processors and are forced to reduce them.

The corresponding report was made by the head of the department of tax and budget policy of the National Research Center "Institute of Agrarian Economics" Leonid Tulush. However, a careful analysis of the data with reference to Eurostat shows that the situation is opposite.

First of all, Leonid for some reason analyzes prices as of November 2021, although processors reduced prices in late December, and his report took place in January 2022.

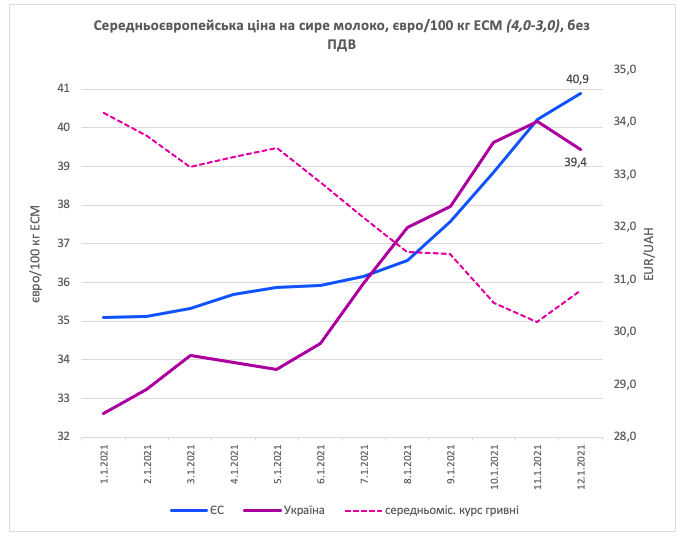

At the same time, since December, prices in Ukraine have been significantly lower than in the EU. Let's make a reservation that we are talking about extra-grade milk, which is only allowed for processing in the EU, and in Ukraine it is the most expensive, despite the fact that its share in our processors is just over 30%.

The analysis also excludes the factor of currency fluctuations in the last year, which was very significant and which, in fact, was the only reason why the price of our milk was higher than the European ones in August-October.

Ukrainian prices are given to the quality indicators of milk used in the EU by their energy value: fat and protein, to compare the comparable (see chart №1).

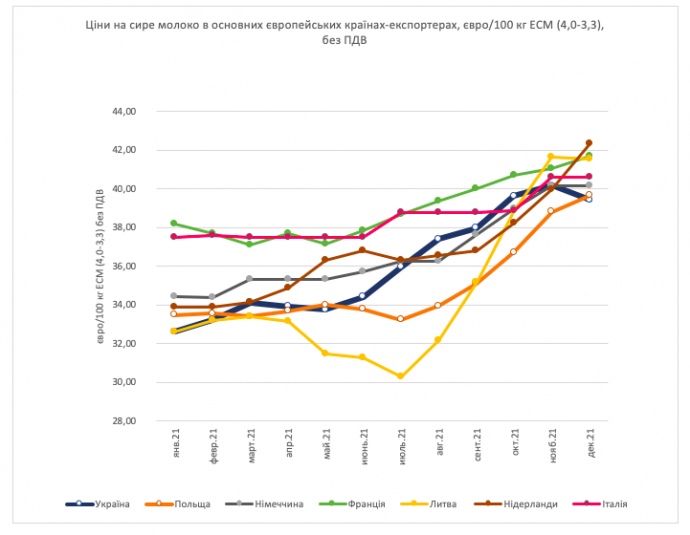

Also, showing data from EU countries during the year (up to the end of November), processors for some reason chose those who are not prominent exporters to Ukraine: Bulgaria, Latvia, Lithuania, Slovakia, Hungary.

Indeed, in these countries during the year prices were lower than in Ukraine, but there are no volumes of milk for sale in Ukraine, ie they do not affect the Ukrainian market.

But the countries that produce a lot of milk: France, Germany, the Netherlands, which actually export their products to Ukraine in significant quantities, for some reason fell out of the analysis again (see chart №2).

The only exception is Poland, but they also decided not to give data on it in December, probably because in December prices there were higher than in Ukraine.

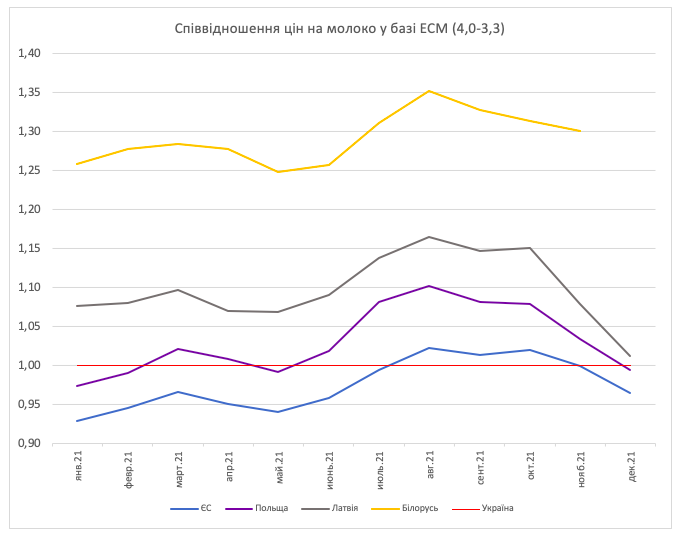

The report also provides information on how much the price in selected countries was higher than in Ukraine.

At the same time, the figures, for some reason, were inflated. For example, in the same Poland, the maximum exceedance was 10%, not 15% (Graph 3), and in the EU as a whole - a little more than 2%, but not 8%, as it was reported.

The situation with the calculation of the profitability of milk production was even more interesting and eloquent.

To show that Ukrainian farmers should "share the margin" with processors, data on the profitability of livestock with crop production included.

It turned out that profitability remains, but again they kept silent about the fact that it is lower than crop production. In other words, if the average farmer slaughters the herd for meat, fires workers, stops growing feeds, and grows grain and industrial crops for sale on the same land, he will earn more.

What does it mean? This means that animal husbandry is, in fact, unprofitable, and its formal high profitability is only a date manipulation, when feed is taken into account not at market value, but at the cost of its production.

It is like uniting a gas producer and a dairy plant and make one legal entity and on this basis declare that milk processing is a profitable business, because if you take into account gas when drying milk at the cost of production, it really will be very profitable.

But gas producers are in no hurry to buy processing plants, although they have money to do so.

And the last point - is the data on the cost of feed, which is more than half the cost of milk production.

They say that Ukrainian farmers bought soybean meal in November for USD442 per ton, at the average NBU exchange rate it is UAH11,690 per ton, although in reality in Ukraine it cost UAH14,150 without VAT.

The data were taken from the international market of GMO (genetically modified organisms) soybean meal, which is prohibited to be used in Ukraine. It is not clear enough why this calculation was made, because every farmer knows at what price soybean meal can be bought or sold and what prices are on the market.

Will the Antimonopoly Committee of Ukraine help?

So, it turns out that milk processors are all right and they are just trying to receive a profit at the expense of farmers? Yes and no. Of course, it is difficult for them to compete with European producers who have great state support, as well as export subsidies.

In addition, they really suffered because of gas prices rising. However, there are some milk processors who did not reduce prices at all. So how do they manage to keep working, process milk and not try to corner their partners?

Someone began to use solid fuel instead of gas, so they are no longer worried about prices increase. Someone left the retail chains, which take up to 40% of the selling price, despite the fact that officially the markup is 15-25%, it simply does not take into account bonuses and fees for marketing services, which processors do not need at all, and consumers do not receive any benefits.

Someone has found other ways to increase their efficiency, such as high-margin innovation products.

And someone, who could not do any of the above, decided that to pay for his slowness should a farmer (a milk producer), just because he has the money earned from crop production.

Finally, 24 milk processors inform their suppliers about the simultaneous prices reduction and at the same time to claim that there was no conspiracy. This is also an art!

In this regard, there is only one question: does the Union of Dairy Enterprises of Ukraine leadership have something to tell us about this situation?

It is no coincidence, that during the meeting of the association's board the heads of 18 enterprises (ie 70% of its members) simultaneously, but quite "accidentally" and "independently" came up with the idea to reduce purchase prices from January 1, although due to the devaluation of UAH milk has already been lower than in the EU?

Farmers sincerely hope that the specialists of the Antimonopoly Committee of Ukraine will help the leadership of the Union of Dairy Enterprises of Ukraine to find an answer to this difficult question.

However, it would be better for everyone not to look for it, but simply to return to the partnership, admit the mistake and start the conversation from scratch, as it was suggested by the Association of Milk Producers.

Co-author: Anna Lavreniuk, Director General of the Association of Milk Producers (AMP)

Friday, 21 January 2022