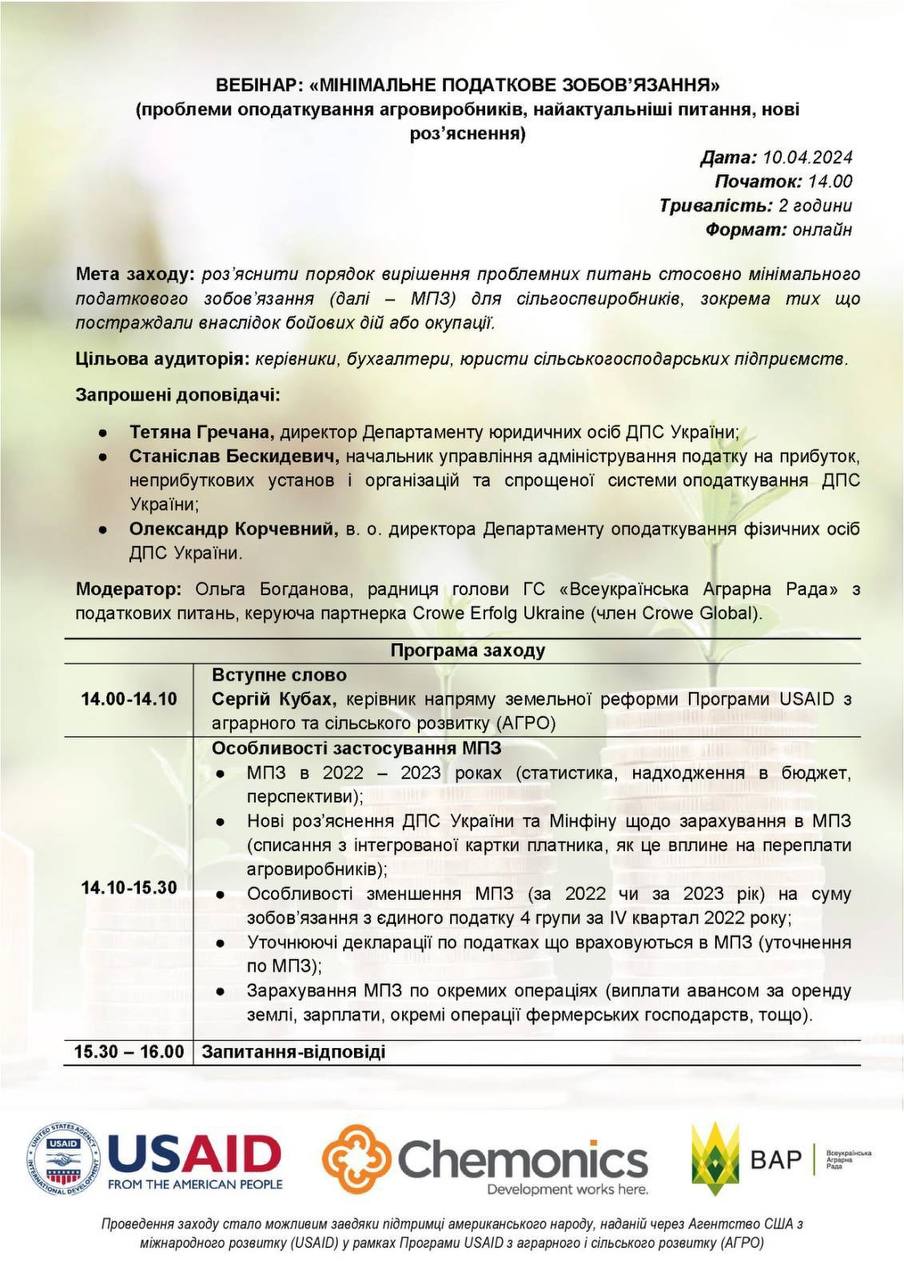

On April 10, 2024, at 2:00 PM, a webinar will be held: "Minimal tax liability" (problems of taxation of agricultural producers, the most pressing issues, new clarifications).

The event is organized by the Ukrainian Agri Council with the support of the USAID Agriculture Growing Rural Opportunities Activity in Ukraine (AGRO) within the joint project "Supporting agricultural MSMEs affected by active hostilities or Russia’s temporary occupation".

Participants will be explained the procedure for resolving the main problematic issues regarding the minimal tax liability (hereinafter - MTL) for agricultural producers, in particular those affected by hostilities or occupation

Invited speakers:

- Serhiy Kubakh, Land Reform Team Lead, USAID Agriculture Growing Rural Opportunities Activity in Ukraine (AGRO)

- Tetyana Hrechana, Director of the Department of Legal Entities of the State Tax Service of Ukraine;

- Stanislav Beskydevych, Head of the Department for the Administration of Income Tax, Non-Profit Institutions and Organizations and Simplified Taxation System of the State Tax Service of Ukraine;

- Oleksandr Korchevnyi, acting Director of the Department of Taxation of Individuals of the State Tax Service of Ukraine.

Moderator: Olha Bohdanova, Tax Advisor to the Chairman of the Ukrainian Agri Council, Managing Partner of Crowe A&A Ukraine and Crowe Erfolg Ukraine

Link for pre-registration: https://forms.gle/8h9md9c9WV5w2J2d8

Detailed program of the webinar: